Artificial Intelligence

What Are Robotics And Automation Investment Funds?

Robots and automation investment funds whether investing in public equities or in early-stage start-up are being encouraged by the waves of development coming out of the industry – principally the benefits that robotics and automation offer businesses with regards to productivity and the feeling that this will be the source of enduring returns going forward

Here we look at a couple of the areas that robotics and automation investment funds are looking at and how you can start investing in robotics and automation in 2022.

Investing in Automation and Robotics in the Food Industry.

In agriculture, robotics investment funds are increasingly looking to invest in technology that will increase farm productivity and reduce the need for manual labor which is increasingly in short supply – especially in the UK after events such as Brexit and demand on food supplies increasing as a result of population increase. In the food industry more generally there is a huge potential for automation ranging from precision agriculture, sorting and packaging, and cookery and delivery.

Investing in Automation and Robotics in manufacturing

Robots are becoming increasingly important in the manufacturing sector, as they can help to increase productivity and automate tasks.

In the early 1990s, there were only 20 industrial robots per 10,000 employees in the US. However, this number has since increased tenfold, and there is still potential for further automation in the future.

The automotive industry currently has the highest robot density, with 1,200 robots per 10,000 employees. However, Amazon as a single entity is quickly catching up, with 3,000 robots per 10,000 employees. This suggests that there is significant potential for growth in the robotics and automation market and therefore a potentially interesting area for robotics and automation investment funds to explore.

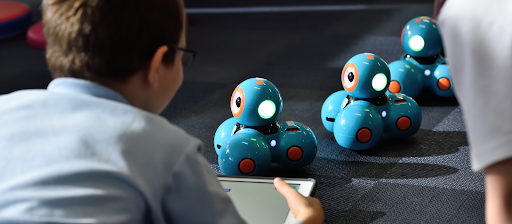

In recent years, the use of collaborative robots (or “cobots”) has begun to disrupt the traditional industrial robot market. Unlike traditional industrial robots, cobots are much easier and cheaper to program and set up, which has made them more accessible to smaller manufacturers. This shift could have a major impact on robot usage throughout the manufacturing industry as a whole, with cobots potentially helping to close the productivity gap between automotive manufacturers and the rest of the manufacturing sector.

Also, read 3 Things To Know About Been A Successful Entrepreneur

Investing in Automation and Robotics In healthcare

Healthcare costs, both on a global and national level, are rising at unsustainable levels due to growing aging populations, increase in chronic disease, shortage of doctors and nurses, lack of access to care, and increase in digital demand by hospitals and patients.

Two interesting examples of automation in healthcare are telemedicine and genetic testing.

Automation is helping to solve various issues that healthcare is facing, such as rising costs and the shortage of doctors and nurses. Telemedicine is a great way for patients who are unable to leave the home for a traditional provider visit, and genetic testing can help with earlier diagnosis of diseases. This allows for a better quality of life for patients in the long term. Again, investing in startups in this area could be an attractive profile for robotics and automation investment funds.

Also, read 6 Essential Equipment Needed to Revamp Your Tech Company

How to invest in robots and automation?

There are several ways to invest in robots and automation, depending on your interests and goals. There are distinctions which it is important to draw from an investor’s perspective

- Investing in a later stage automation and robotics company vs investing in an early stage start up. Early stage investing in robotics companies can give a great chance of sizable upside. However, this comes with less liquidity and higher chance of business failure.

- Investing directly into robotics / automation companies directly i.e. as an isolated investment vs investing into a robotics investment fund containing a basket of different robotics companies. Investing in a robotics investment fund directly can be beneficial to diversify risk and put less pressure on you as an investor to source investment propositions.

- 3. If choosing to invest in a robotics investment fund are you looking to invest in publicly traded companies (e.g. an ETF) or privately held venture capital funds – the former will have more liquidity, the latter more chance of an upside.

- Do you care about tax benefits? The UK seed enterprise investment scheme and the enterprise investment scheme are two ways which provide early stage investors investing in automation and robotics additional inducement via tax reliefs to do so. Later stage robotics investment funds investing in public market companies will not be able to provide these.

-

Blog1 year ago

MyCSULB: Login to CSULB Student and Employee Portal – MyCSULB 2023

-

Android App3 years ago

Cqatest App What is It

-

Android1 year ago

What Is content://com.android.browser.home/ All About in 2023? Set Up content com android browser home

-

Software2 years ago

A Guide For Better Cybersecurity & Data Protection For Your Devices

-

Latest News2 years ago

Soap2day Similar Sites And Alternatives To Watch Free Movies

-

Android2 years ago

What is OMACP And How To Remove It? Easy Guide OMACP 2022

-

Android3 years ago

What is org.codeaurora.snapcam?

-

Business2 years ago

Know Your Business (KYB) Process – Critical Component For Partnerships